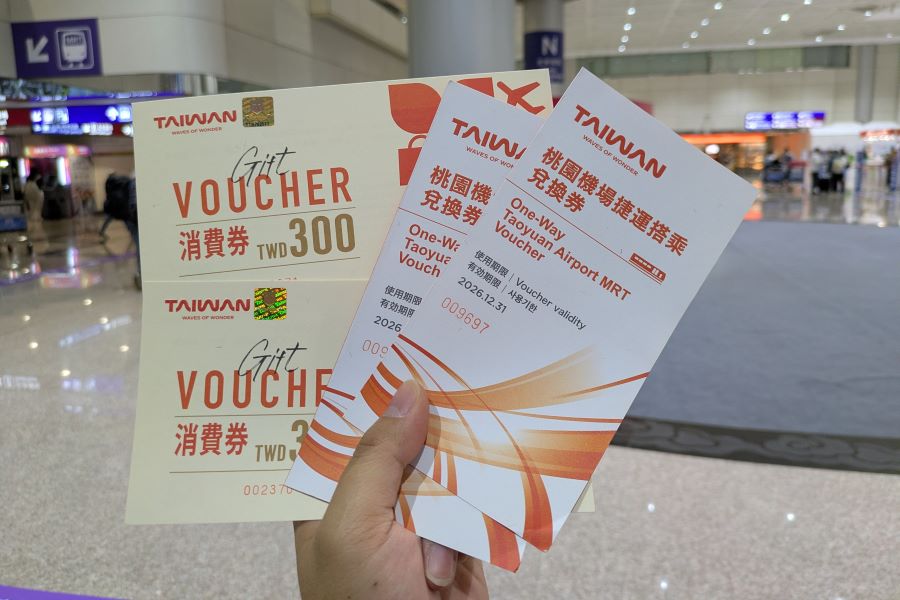

Tried It: Taiwan Tourism Administration’s Transit Gift Voucher Campaign at Taipei Taoyuan International Airport

However, looking back approximately a month ago to the end of October, JR East’s interim financial results told a completely opposite story.

The operating revenue for the second quarter (July to September) increased by approximately 953 billion yen (about a 7.3% increase) from the same period last year, to approximately 1.3951 trillion yen. The words ‘increase in revenue and profit’ are impressive across various segments including railways.

The company is also making impressive large investments such as the introduction of the Chuo Line Rapid Service Green Cars, and the scheduled opening of TAKANAWA GATEWAY CITY near Takanawa Gateway Station after 2025.

Presenting its mid- to long-term business growth strategy ‘Beyond the Border,’ JR East seems brighter than ever, benefiting from the increase in inbound tourism. It’s hard to see it as a company that needs to increase fares by 20% citing ‘harsh management conditions.’

JR companies, including JR East, are public transport services inherited from JNR. However, being listed companies, they are also required to generate profits for investors. Balancing public accountability and profitability is challenging and might present a dilemma. How JR East tackles this dilemma will be interesting to watch.

Furthermore, the Ministry of Land, Infrastructure, Transport, and Tourism is soliciting public comments on this fare revision application until December 23.